It’s hard to plan ahead when the destination isn’t clear…

But what if you could see your future, and understand how to get there?

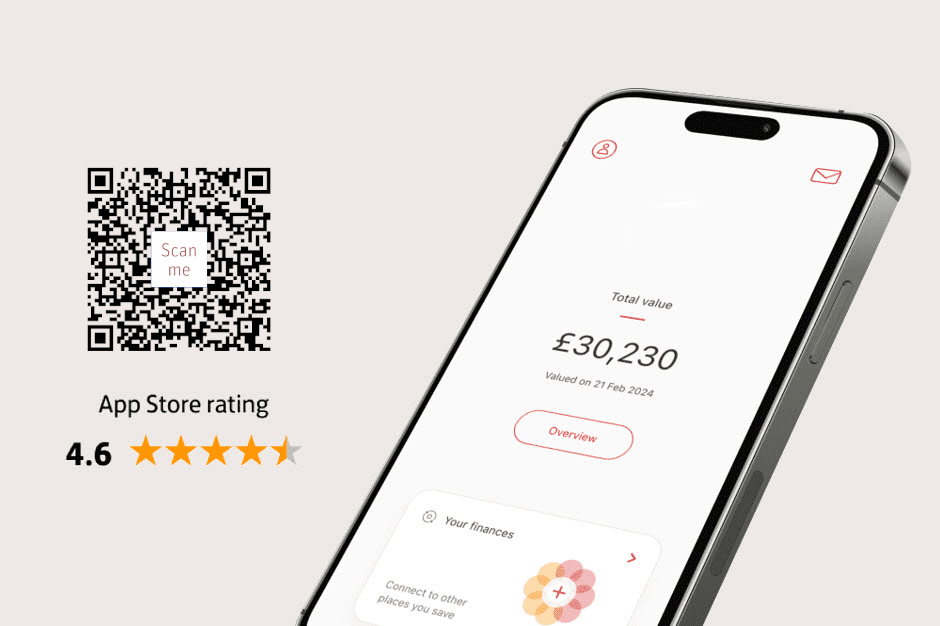

Welcome to the Scottish Widows app.

Giving you a true picture of what you have today, by bringing the far off to the here and now.

You can see the value of your Scottish Widows pension, in real time, and connect pensions you have with other providers.

Our app can then project these alongside your state pension, showing you the type of retirement you can expect in the future.

You can connect with your other accounts too, like your banking, savings and investments.

Once they’re connected, they’ll appear in your overview, so you can see the future of your finances taking shape.

Investing can go beyond retirement savings.

Ready-Made Investments are built and managed by Scottish Widows.

They’re available as a general investment or as an ISA.

And there’s plenty of useful information on hand, so you can decide if our account is right for you.

If you’re interested, you can choose the appropriate level of risk, and set the monthly amount you’d be comfortable depositing.

You can then track the progress and performance over time, just like you can with your pension.

It’s good to know you can navigate life’s uncertainties with confidence by protecting the things in your world that matter most.

Our Insure space gives you an overview of the insurance policies you have with Lloyds, Halifax and Bank of Scotland.

That’s because, like Scottish Widows, we’re all part of Lloyds Banking Group, and you’ll soon be able to add products you have with other providers too.

It shows you where you’re protected and any insurance gaps you might want to fill.

just tap the shield in the navigation bar, and you’ll be guided to the dedicated space where you explore your options.

As well as planning ahead, there’s lots you can act on right now.

Like nominating your beneficiaries, transferring and combining other pensions you may have, seeing where your Scottish Widows pension is invested, and switching to funds that suit your goals.

You can also explore our BeMoneyWell hub, where you can connect with financial expertise and support…

Get key insights on how to make the most of your pension, and find the answers to many of your questions…

Our Responsible Investments insight is all about giving you the bigger picture.

You can check out how your funds are performing, and dive deeper into where and how they’re invested…

See what a company’s carbon footprint is, or the different people that make up their Board...

One app to help you save for the long term.

One app to stay on track.

One complete view of your finances.

See your future and take control today.

Download the Scottish Widows app now.