Take a small step towards a bigger pension

It's Pension Engagement Season and we're here to help you plan ahead for the future with two simple pension steps, KNOW IT and GROW IT.

Know it

Knowing how much you’ve already got in your pension, and how much you’ll need for retirement is a great place to start.

How much have I got in my pension?

-

If you have any other type of pension with us

If you're a Scottish Widows customer with any other type of pension, why not check out our online service.

Take a few minutes to register your pension then you can log in and check it any time.

-

If your pension is with another provider

- Visit their website for information on how to check your pension

- If you are unsure who your provider is, ask your employer

- Find your annual benefit statement, this should have your latest value and all the details you need

Check your pension in our app

If you’re a Scottish Widows customer with a workplace pension, you can check how much you have in your pension in our app. We also have lots more exciting features:

- See how much you currently have in your pension

- View how much you could have for your retirement with our projections

- Combine your pensions

- Check the impact your pension is having on the world

- Manage all your pension admin

How much do I need at Retirement?

The PLSA (Pension Livings Standards Association), say for a comfortable retirement people need £43,000 per year.

Try our pension mirror

The Pension Mirror will guess how old you are and show how your pension compares to others your age.

Beat the gap

The gender pension gap jumps from £100 to £100,000 over a woman’s working life. We can help you beat the gap with top tips to a better future.

Know your pension

Get to know your pension. From the pension basics to the more in depth. We’re here to help.

Know your state pension

Do you know how much you’ll get and when?

75% of people in retirement rely on the State Pension to help pay for essentials.

Know your investments

Did you know your pension is invested? That means it can go up and down in value over time, and you have lots of options to choose from.

Grow it

Now you KNOW IT, it’s time to GROW IT. There are lots of ways you could help your pension grow from saving a bit more every month, tracking down any lost pensions you might have and combining existing pensions.

6 Tips to make the most of your pension

If you only save the minimum into your pension it could mean less money to enjoy in retirement. Watch our top tips to help you take a small step towards a bigger pension.

Can you save more?

Putting a bit more away each month could have a big impact on your retirement savings. See the difference it could make for you.

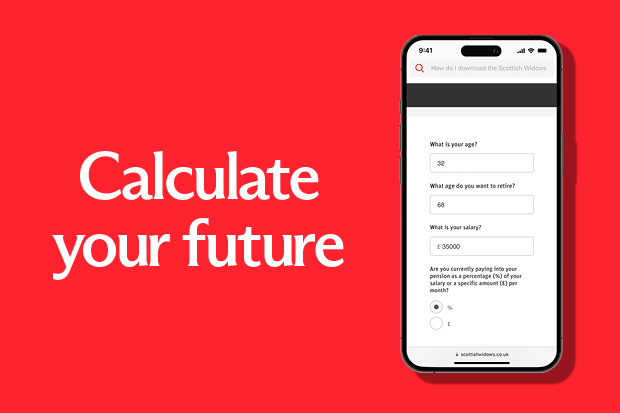

Meet your future self

How are you shaping up for retirement? Answer a few short questions and see when you could retire, and what you’ll look like when you get there.

Combine your pensions

If you have multiple pensions, combining them into one could save you time and money.

Explore our App

As a Scottish Widows workplace customer, managing your pension has never been easier than with our app.

1. See it

See your pension savings like never before. Take a look at what you have now so you know what to do next.

2. Know it

Paint your total pension picture because knowing your pension inside out could really help grow your pension.

3. Grow it

Boost future you today. Learn how you could boost your retirement savings to match your ideal retirement lifestyle.

What's next

Now you know the steps to take towards a bigger pension. Here are some other helpful resources.

Pay your pension some attention

Face the future with confidence with our industry wide campaign to pay your pension some attention.

Follow us on TikTok

Know It and Grow It on TikTok with our new channel. Take a small step towards a bigger pension and search Scottish Widows for access to our hub.

Any questions?

Our virtual assistant is ready to help.

Start chatting to ask about anything and everything pensions.