Welcome to your Workplace Pension

Jaguar Land Rover Defined Contribution Fund

Your pension information site film

Thanks for saving with Scottish Widows and trusting us to help you make the most of your financial future.

Your pension information site has lots of information to help you understand more about your pension.

Film running time under 2 mins.

How does a Workplace Pension work?

Your workplace pension is a long-term savings plan. Even if retirement feels like a long way off, the earlier you save, the more time your money has to grow.

If you pay money in, your employer may too. You'll also benefit from tax relief from the Government and potential investment growth. Tax benefits will depend on individual circumstances, but keep in mind that tax rules can change.

Film running time under 3 mins.

Retirewell webinar series

Join our pension experts for a programme of live webinars and get the chance to ask them anything about your workplace pension.

Important things to do

Beware of scams

Watch our film to find out how to spot a pension scam.

Film running time 1.5 mins.

Planning for your future

State Pension film

Watch our film on the State Pension to find out more.

Film running time under 5 mins.

Supporting vulnerable customers

This film explains the additional support services available to you through our partnerships. You can also learn more about these in our support guide (PDF, 1MB).

Film running time 2 mins.

Tools & calculators

-

Start now Opens third party site in a new tab

Start now Opens third party site in a new tabFirst we’ll guess your age. Then we'll show you what people the same age have saved in their pension. Having something to compare yourself to is a great first step in checking whether your pension is on track.

-

Meet Your Future Self Opens third party site in a new tab

Meet Your Future Self Opens third party site in a new tabOur Meet Your Future Self tool lets you see when you're on track to retire based on your current pension value, contributions and goals. You'll also see how making small changes could help you reach those goals earlier.

-

Use the calculator Opens third party site in a new tab

Use the calculator Opens third party site in a new tabOur retirement calculator can help you find out what your income and lifestyle could be in retirement.

Having the value of any pensions, savings and investments you have will help you get the most out of the calculator.

Library & resources

-

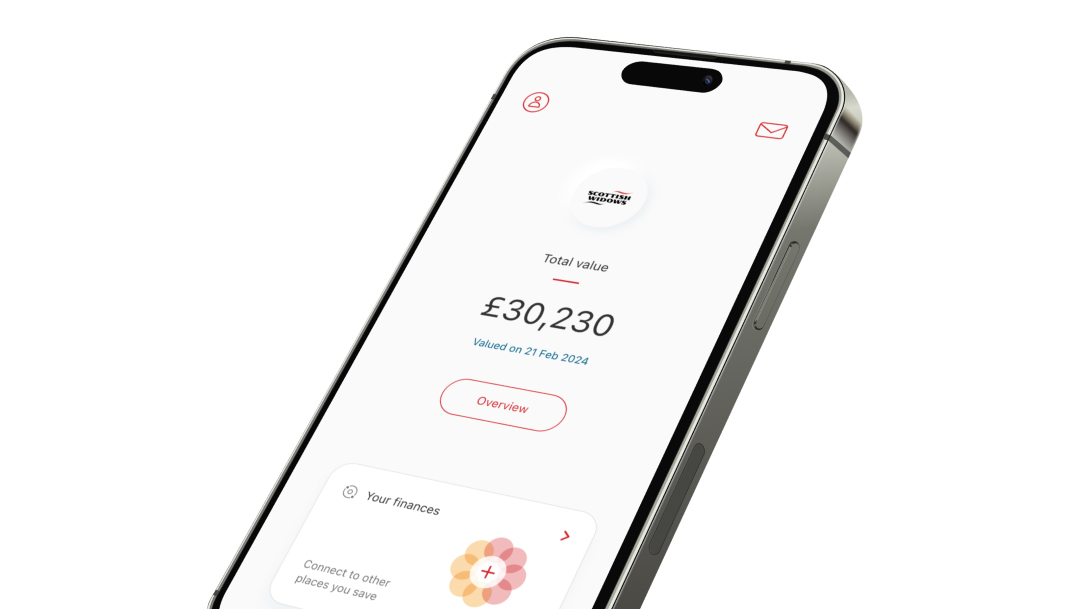

Below you will find information about your investment options and charges. You can make changes to where your pension savings are invested through the Scottish Widows app or by logging into your secure portal.

Jaguar Land Rover Defined Contribution Fund information

Investments library and resources Your investment choices and charges (PDF, 400KB)

This short guide lists the pension fund choices available to you and the total annual fund charge for each fund.

Explore information on the alternative investment options available to you, past performance, their charges and their fund factsheets.

Guidance on your fund choices (PDF, 900KB)

This short guide provides information on the different fund choices that are available to you, including the various lifestyling strategies available.

The following provides more information about how your pension savings are invested:

Investment choices and charges Introduction to investing (PDF, 3MB)

In this detailed guide you'll find information on how investing works, what a default investment option and lifestyling strategy is, as well as the different types of assets you can invest in and their risks.

If you want to keep up to date with the latest investment trends, or just learn about the basics, we’re here to help. We’ve got useful information and thoughts from our experts on the Exploring investments webpage.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

-

The following guides can be used to help you think about your options:

Retirement options library and resources Helping You Prepare for Your Retirement (PDF, 1MB)

This detailed guide explains the options available to you when you want to start taking your benefits and the key things to consider before you do.

This detailed guide from MoneyHelper also explains your retirement options, as well as the free retirement service that may be available to you through Pension Wise.

Things to Think About at Retirement (PDF, 100KB)

This short leaflet provides an overview of some of the key things to consider as you get closer to taking your pension benefits.

Hub Financial Solutions - Annuity Service (PDF, 100KB)

This short guide, from the independent Hub Financial Solutions, explains the Annuity Service they provide. This service can help you select an annuity if you decide this is the right option for you and your needs.

The following guides explain your flexible income drawdown options:

Flexible income drawdown options library and resources This detailed guide explains how flexible income works, how we invest your savings and the risks associated.

Flexible Income Fund Range (PDF, 1MB)

This detailed guide gives you an understanding of the funds you can invest in if you wish to take a flexible income.

This detailed guide provides key information to help you understand our Investment Pathways and choose the right one for you if you decide to take flexible income.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

-

Key Features and Terms & Conditions library and resources Key features of your plan (PDF, 300KB)

This detailed guide contains important information about your plan and how it works.

Key features illustration (PDF, 700KB)

This short illustration shows our standard charges and how they could affect what you might get back. Your actual charges may be different from those shown, please see your personalised illustration for details.

Terms and conditions (PDF, 400KB)

This contains details of the terms and conditions of your plan.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

-

Useful information library and resources Pension tax (PDF, 3MB)

In this detailed guide, you'll find information on how current tax legislation affects how you save for retirement. There's information on the tax implications on your pension savings, including how tax relief works.

Pension transfer guide (PDF, 300KB)

This guide describes the potential benefits of transferring existing benefits to your Retirement Saver and highlights some of the things to consider.

Transfer in form (PDF, 1MB)

If you decide to transfer and don’t want to complete our online transfer journey, please complete this application form.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

Contact us

-

When you speak to us, we’ll ask you for your plan number. This helps us to make sure you’re speaking to the right team. If you don’t have your plan number, we can still help you.

We will then ask you some security questions, so we can check who you are.

We want you to get the best service, so we may record your call for training purposes.

-