How to beat the £100k gender pension gap

Alison Nicolson and Jane Clark-Hutchison

Co-Heads of Client Relationships

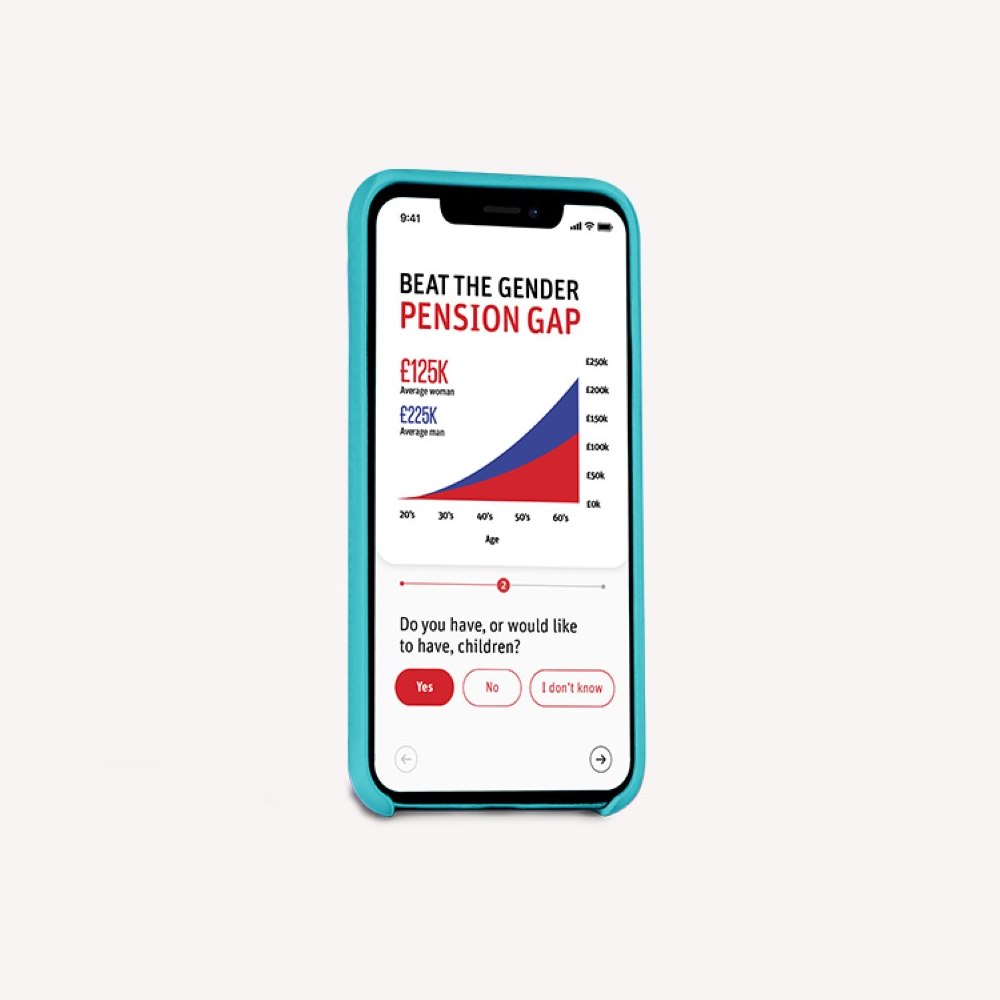

The gender pension gap jumps from £100 to £100,000 over a woman’s working life

But as one company shows, it doesn’t have to be this way.

It’s hard to believe that the gender pension gap jumps from £100 to £100,000 over the average woman’s working life. We don’t have to accept this.

Let us tell you about a client of ours we are really proud of, and whose story we want to share. They don’t have a gender pension gap. None – and this is highly unusual.

No gender pension gap

The company has achieved this thanks to policies which include generous maternity leave while maintaining full pension contributions.

This has led to more women employees returning to work, progressing their careers, and earning higher salaries with increasing pension contributions.

Just as helpful is their approach to pension enrolment, with everyone included in their Scottish Widows’ DC company pension scheme regardless of their age or earnings. Removing the age threshold which currently applies with auto-enrolment means some employees – men as well as women – can start to save earlier with more years to build up their pension savings.

Clearly, they’re ahead of the government’s bill on extending auto-enrolment, a consultation on which is due later this year.

First-hand experience of the gender pension gap

Their approach bucks the usual trend for gender pension inequality, which normally starts to widen considerably when women reach their 30s and 40s. Childcare and returning to work part time after having a family are the biggest drivers – and it’s something we’ve experienced at first hand ourselves.

We both took time out to have a family, and now work part time in a job share as Scottish Widows’ Co-Heads of Client Relationships. We’re all too aware now of how our choices have affected our retirement incomes.

Beat the gap

We launched our Beat the Gap tool on International Women’s Day in March so that everyone has the chance to see how things like working part time and taking time away from work to raise a family can affect women’s retirement savings. It’s not just for women, it’s for everyone who cares – husbands, sons, partners, employers.

The Beat the Gap tool joined our International Women’s Day takeover of our Pension Mirror, first launched during Pension Engagement Season last year, to get everyone talking about pensions. If it helps to close the gender pension gap it will be something worth shouting loudly about.

Please share the link to our Beat the Gap tool and encourage everyone to download it.

And find out the top three actions women can take to make the most of their pension savings on the Your Future Hub.

For use by UK employers and advisers only.