Putting more in

Save more for your future, today

You can still make a difference to your retirement by paying more into your pension. You might be saving into a pension you took out - through an adviser, through your bank, or directly with us. Or it could be a pension you have through your job, or a job you had in the past, which we call a workplace pension.

Look at what you’ve already saved

First, look at your pensions to see how much you might have at retirement. You might also have an ISA or other savings. If you don't need these savings for a rainy day, could this money help you in retirement?

Think about paying more in

Now might be a good time to think about saving some more, to boost your lifestyle later. Even saving just a little more than you do already, can make a big difference.

Find out more about saving. Guide to savings

Get a boost from tax relief

There are various ways you may receive tax relief, as this is dependent on how your pension plan is set up. If you have a workplace pension, you should check with your employer to find out what type of pension you have.

This example is based on a Workplace pension and demonstrates tax relief at source also known as basic rate tax relief. It shows that the total invested into your Workplace pension on a monthly basis could be £200 even although the monthly cost to you is £100.

If you're in an occupational scheme, such as a Master Trust, you will get tax relief in a different way. Read our Guide to Pension Tax (PDF, 2MB) to find out what this means for you.

If you have a personal pension, it will be relief at source.

If your scheme is set up on a salary exchange basis, it will work differently. Watch our video below and speak to your employer for more details.

Think about tax

The amount of tax you need to pay will depend on your circumstances. Tax rules and your circumstances may change in the future. This could affect how much tax you pay. For more information on all UK tax rates, visit the HM Revenue & Customs website. Income Tax - GOV.UK (www.gov.uk)

Want to pay more in?

-

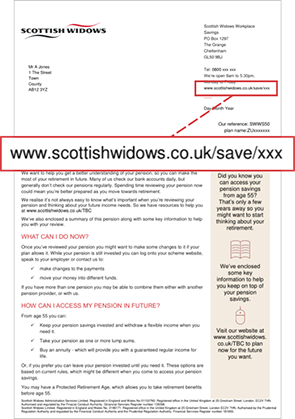

If you’ve got a workplace pension with us, your scheme has a website telling you about your pension and your options. The web address is on letters we send you.