Addressing the decumulation dilemma

Pete Glancy

Head of Policy at Scottish Widows

Is a retirement income about flexibility, certainty, legacy – or a mix?

Auto-enrolment has delivered a robust and well-established pension saving model, but the pension income side of things is less well developed.

Those who can’t afford the services of an Independent Financial Adviser will undoubtedly struggle to construct their retirement income in a way which meets their needs and those of their family, and last them as long as they need it to.

Meanwhile, policy makers are still working through regulatory and legislative approaches which will determine what is, and isn’t, possible in the future.

Asking 1,500 retirees what they want from a retirement income – using plain English and avoiding complex product terms – has helped us shape our new ‘Decumulation: Understanding the Needs of the Nation’, report. It looks at what people want from their retirement income as they weigh up flexibility, certainty and, for some, the importance of leaving a legacy for their loved ones by passing their pension on.

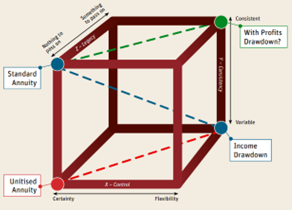

Mapping their needs and wishes onto a simple model in the form of a 3D cube (pictured, below) captures this in a more visual way which hasn’t been possible before.

Retirement matrix

We’re calling this a Retirement Matrix tool which allows current products and any new potential ones to be mapped onto a simple 3D cube.

Simplifying things visually is designed to make considerations such as default decumulation options and the potential role of Collective Defined Contribution (CDC schemes) easier to envisage. It also better illustrates how products currently in the market might be used to best effect.

All retirement income products have attributes which sit on three distinct but interconnected axis.

- On the ‘Control’ axis: a product can facilitate flexibility of expenditure at one end, and the guarantee of income for life at the other.

- On the ‘Consistency’ axis, a product can smooth returns over time so that income is predictable throughout retirement for budgeting reasons; or at the other end of that axis can be invested to seek higher levels of income but with a risk that the income in retirement might fluctuate.

- On the ‘Legacy’ axis, a product can facilitate benefits for dependents if a customer passes away early in retirement; or can exclude those benefits to secure a higher income for the owner of the pension pot.

Our new report ‘Decumulation: Understanding the Needs of the Nation’ (PDF, 7MB) not only creates a tool which allows the product landscape to be set out more visually, but it also allows customer demand to be captured in a way which hasn’t been possible before, with that demand then overlaid on to the model.

We see that 80% of customer demand sits on the left-hand side, which signifies an ‘income for life’. The 70% of demand sits in the back wall and reflects a desire to pass on some pension wealth were customers to pass away early in retirement. Then there’s the 55% sitting on the roof on the cube which signifies a desire for a predictable income from one year to the next, for budgeting purposes.

What’s the conclusion?

Most demand sits at the back left of the cube, where needs could be met for example by annuities with guarantee periods, whether these be level, indexed or variable annuities. Yet these products currently play next to no role in retirement income.

Decumulation-only CDC is a discussion point in the public policy space. ‘Whole of Life’ CDC doesn’t permit smoothing of returns over time or death benefits. These restrictions would limit demand quite considerably if applied in the future to Decumulation-only CDC, making that a niche product. If any future rules facilitating Decumulation-Only CDC were sufficiently flexible to permit the smoothing of investment returns to deliver predictability and allowed for any element of death benefit to meet the ‘legacy’ need, it’s likely that customer demand would be significantly greater.

We can see, however, that customer demand is all around the cube. This tells us that there isn’t a single product that could easily be used by Trustees in establishing default decumulation arrangements in the future and that a more sophisticated framework will be needed.

Everyone is different, and it’s likely that combining more than one product appropriately will be closer to the retirement income needs of many people.

IFAs are skilled at helping people combine products in this way, but not everyone can afford their services. We need to help people who are less affluent benefit from these same outcomes, but we don’t yet have all of the tools.

The FCA’s discussion paper which considers new ideas for tackling the advice gap is very welcome. Our research also explored which of those new ideas would be most helpful and which additional tools would best equip us to more fully meet customers’ needs.

Those findings too can be found in our report.

For use by UK employers and advisers only.