Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Any investment opportunity that promises a high return with little or no risk is likely to be a scam and your money is at risk. Investment scams are increasing and they’re getting more and more difficult to spot.

Did you know?

Fraudsters can pretend to be a genuine financial adviser, or company, by setting up fake company websites and using fake email addresses.

They may advertise to you online or send you a message out of the blue with a deal. It’s easy to become a victim of fraud if you click on an advert or reply to a message.

Use the Financial Conduct Authority (FCA) website to find genuine contact details for a company and links to their website.

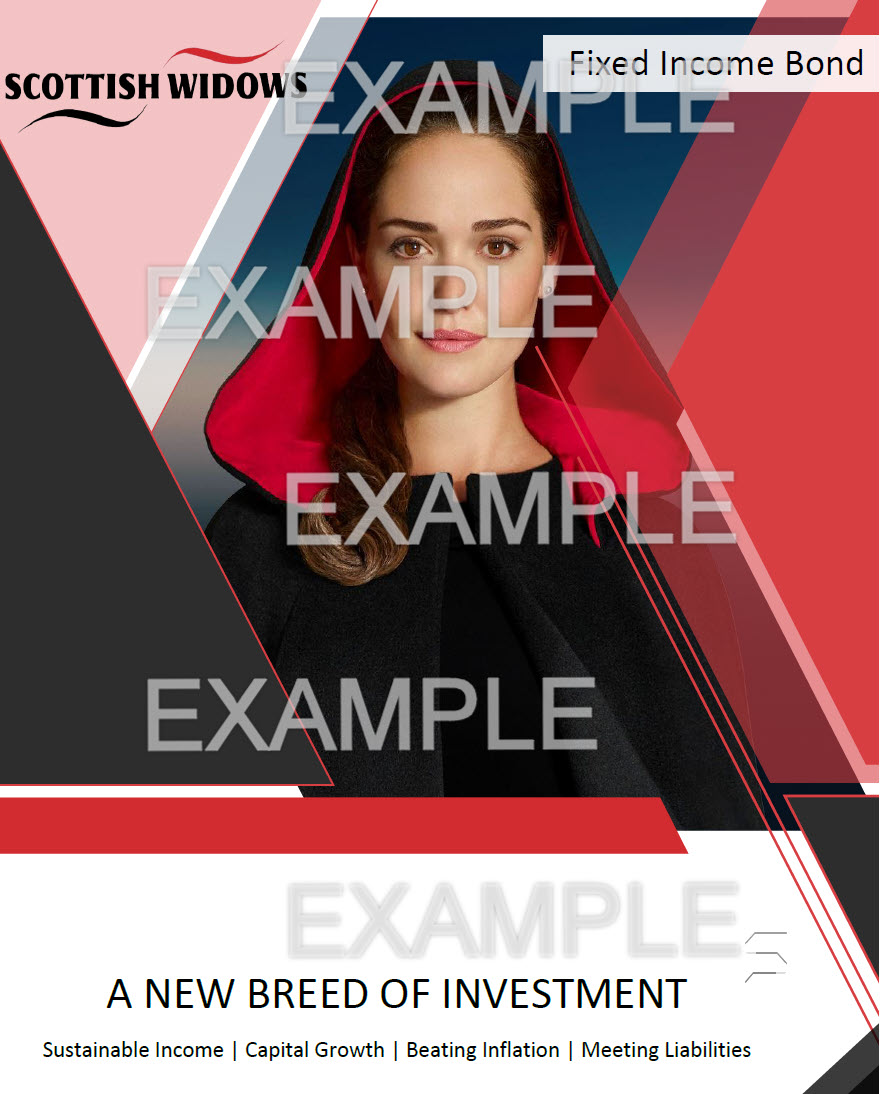

If you’re offered a new investment or savings bond from us, always be suspicious. We’ll never sell this to you directly. Recently, a scam used a fake brochure using our branding:

Fraudsters create glossy brochures to tempt you to invest. These may appear genuine at first as they often include a mix of real information taken from our website and brochures and correctly include our website address.

Always check if the correct spelling of Scottish Widows Ltd is shown within the email address they’ve used to send it to you. Here are some examples of scam emails to look out for.

Spelling mistakes or grammatical errors may also suggest the documentation isn’t real.

If you suspect you’ve been sent a letter or brochure that isn’t real, there are several ways to check:

Fraudsters are constantly thinking of new and clever ways to get hold of people’s money and personal information so it's important to be vigilant. We’ll never rush you into an investment decision so if you suspect something isn’t real, take the time to consider any information you’re sent, or have been told, before taking action.

For more information on scams involving investments, visit www.cityoflondon.police.uk

If you think you may have been approached, or are a victim of investment fraud, please call us. You can also call Action Fraud on 0300 123 2040 or the FCA's consumer helpline on 0800 111 6768.

Remember that if you are a victim of a scam or an attempted scam, however minor, there may be hundreds or even thousands of others in a similar position. Your information may be useful in stopping this happening to others.