Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Were you recently enrolled in a workplace pension? You might be thinking about opting out. But before you do, it’s important you understand what you could lose out on. Find out why your employer enrolled you, what you get out of your workplace pension, and how to opt out.

If you’re over 22 and under State Pension age and earning £10,000 or more a year, your employer should have enrolled you in a workplace pension. This is called ‘auto-enrolment’.

Find out more about auto-enrolment in a workplace pension.

You can opt out within 30 days from the date your employer enrolled you into your workplace pension, and get any contributions you’ve paid refunded. Check that this is the right decision for you.

If you opt out, you may lose out on extra payments from your employer. And opting out now could mean you have less money when you retire.

If you still want to opt out, we can help.

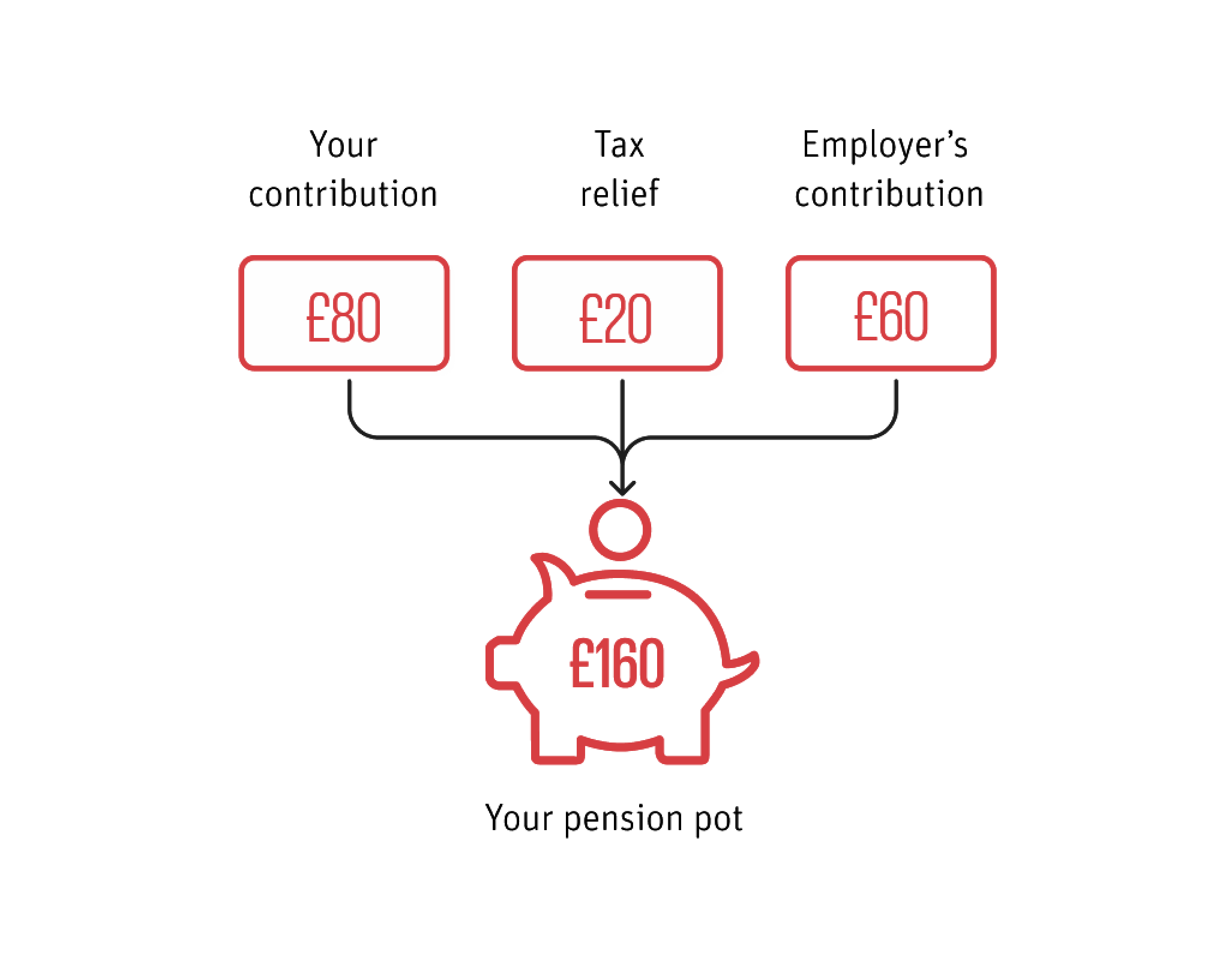

Your workplace pension is a great way to save for your retirement. You get extra money from your employer and through tax relief every time you make a contribution.

Find out more about your Scottish Widows workplace pension.

If you're in an occupational scheme, such as a Master Trust, you will get tax relief in a different way. Read A Guide to Pension Tax (PDF, 343KB) to find out what this means for you.

This example is based on a basic rate tax payer.

Tax treatment depends on individual circumstances and tax rules both of which can change. For more information on all tax rates, visit the HMRC website.

Find out how your pension contributions can be doubled when you pay into a workplace pension.

We've based this example on automatic enrolment, where the minimum contribution is 3% from the employer, 4% from the employee and 1% in tax relief. This would be the minimum automatic enrolment contribution for someone with pensionable earnings of £24,000 each year.

If you are a Scottish or Welsh taxpayer the tax relief you will be entitled to will be at the Scottish or Welsh Rate of income tax, which may differ from the rest of the UK.

When you opt out of your workplace pension:

If your policy number starts with SW

Did your employer send you a letter with a unique reference number? If so, you can opt out online using AssistMe. Your unique reference number will be under your address in the letter. If you’ve lost the letter, your employer can send you a copy.

Opt out online in AssistMe.

If you didn’t get a letter with a unique reference number, or if we’ve told you to fill in a form:

Having problems? Call us on 0345 755 6557, Monday to Friday, 9am to 5pm.

If your policy number starts with ZU

You can opt out online in Money4Life. Your login details will be in the letter you should have got when you joined the pension. You’ll see the link to opt out if you’re still able to.

Having problems? Call us on 0800 032 1260, Monday to Friday, 8am to 6pm.

Opt out online in Money4Life.

We know that getting on top of your finances isn’t easy. If you’re looking to boost your financial skills, our Be Money Well resources and tools will help you get ready for your future.

For independent guidance on topics such as getting help with the cost of living, pensions and retirement, go to Money Helper.