Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Managing Director at Scottish Widows

The gender pensions gap will take at least 20 years to close unless decisive action is taken, according to the latest Women and Retirement Report (PDF, 4MB) from Scottish Widows.

The report has been tracking women’s retirement savings for two decades and in that time progress has been made in closing the gender pension gap – which is the difference in pension savings between men and women at retirement age. However, based on the current trajectory it will take another 20 years to close the gap.

As it stands, the current average gap in pension savings at retirement shows women trailing men by about £100K.

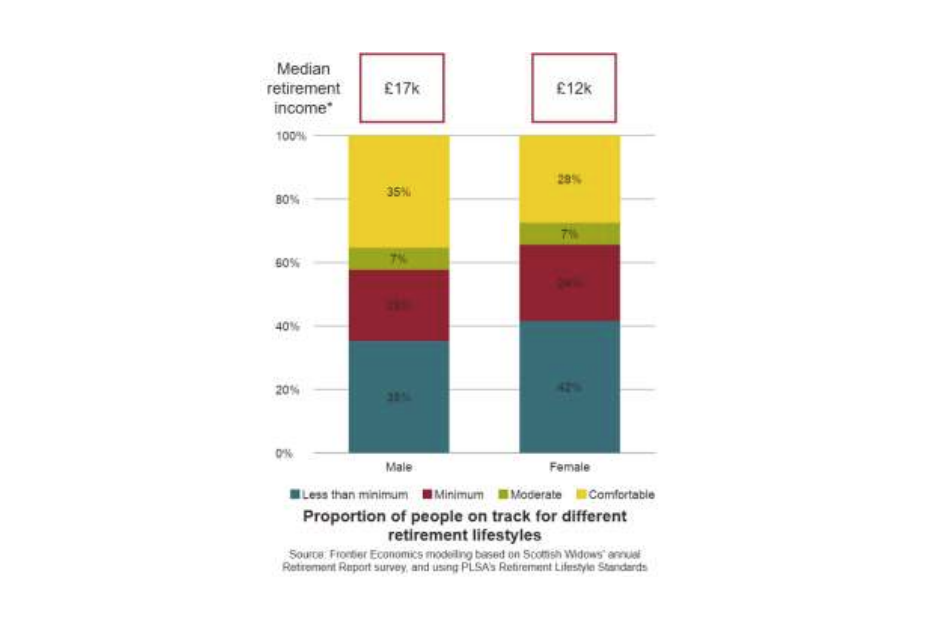

Progress over the last two decades has been driven by policy implementations, an increase in the number of women in employment, a decrease in the gender wage gap* and a gradual shift in attitudes towards women’s roles. However, the gender pensions gap remains at a stubborn 30% in overall projected retirement income, with two fifths of women (42%) currently on track to face poverty in retirement compared to just over a third (35%) of men.

The average woman** is on track to only receive £12,000 per year of total income in today’s money during retirement, after paying for income tax and any expected housing expenses, compared to £17,000 for the average man. Not only is this difference considerable, it also leaves women falling short of meeting the Pensions and Lifetime Savings Association (PLSA) minimum retirement standards of £14,400 for a single person, while couples need £22,400 to cover all their basic needs.

The current ‘pension picture’ for women today…

Significant progress has been made in the past two decades as a result of active policy reforms that have enabled women to prepare better for retirement.

Jackie Leiper, Managing Director, Scottish Widows, said: “Progress has been made on the gender pension gap over the last two decades thanks to game-changing interventions like auto-enrolment and improving equality on women’s pay and role in society. But we are still a long way from where we need to be. Without drastic action, the gender gap will take another 20 years to close, and there is a very real risk that we won’t see pension parity for many generations to come.

“Extending auto-enrolment to support the higher proportion of women who are self-employed, or in part-time work is vital, as is the establishment of a Lifetime Savings Commission. Urgent action must be taken and we must empower more women to take control of their money through life and into retirement, with education, support, and innovative ways to engage with their money.

“The last 20 years has seen a move towards gender parity on pensions – but there is still more work to do to ensure more women can live and enjoy the lives they want in retirement.”

Samia Longchambon, working with Scottish Widows on the launch of the Women and Retirement report, said: "Working, looking after children, and the busyness of day-to-day life can often mean we forget to take a step back and think about what life might look like in the future. I’ve been in the same job for almost 25 years so I’ve been lucky to have the stability of that. Whilst I’ve not reached retirement age yet, it’s definitely not too early for me to think about what life will be like in years to come.

“Scottish Widows research shows that it will be decades before men and women retire with the same amount of money. This means as women, the more we can engage with retirement, especially earlier in life, the better. The Pension Mirror is a good place to start though I can’t promise it will guess your age right!”

Download full press release (PDF, 271KB)

* House of commons library - The Gender Pension Gap (PDF, 637KB)

** The average woman/man in terms of how much retirement income they are on track for.

Notes to editor

Methodology

The report forecasts that the gender pension gap could close in another 20 years if current progress continues, based on the ONS’s Wealth and Assets Survey data. The methodology, carried out by Frontier, calculates the average annual progress that has been made between 2008 and 2020 in the gender gap in private pension pots held by those aged 50-64, and then assumes this average annual progress continues from 2020 onwards. Full details can be found in the full Scottish Widows Women and Retirement Report.

The consumer research total sample size was 3626 adults. Fieldwork was undertaken by YouGov on behalf of Scottish Widows between 23rd - 30th August 2024. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

We use the Pension and Lifetime Savings Association (PLSA)’s living standards as a measure. The PLSA defines a minimum retirement as someone living with no car, spending £50 per week on groceries and spending £20 for each birthday and Christmas present. The latest PLSA thresholds have increased from 8-34%.

About Scottish Widows

Founded in 1815, Scottish Widows is part of Lloyds Banking Group, the UK’s largest digital bank and financial services group. With more than £210bn assets under administration and 6 million customers, Scottish Widows’ award‐winning product range includes workplace and individual pensions, annuities, life cover, critical illness, income protection as well as savings and investment products. Customers can access our products and services through independent financial advisers, directly, and through all Lloyds Bank, Bank of Scotland and Halifax branches