Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Head of Policy at Scottish Widows

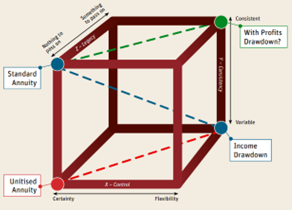

Scottish Widows has today revealed details of a new ‘Retirement Matrix’ tool to help advisers have better conversations with customers and help them boost their retirement income.

The new mapping tool allows all current and potential retirement products to be mapped against what people want from their retirement income on a simple 3D cube, so that it’s easier to see whether retirees’ needs are being met by the products which are currently available.

The ‘Retirement Matrix’ is included in a new report from Scottish Widows called ‘Decumulation: Understanding the Needs of the Nation’ (PDF, 7MB), which shares the views of around 1,500 retirees and near-retirees towards accessing their pension savings, The report reveals a disconnect between what people want from their retirement income and what products they are actually choosing. The report also suggests innovation is needed in developing retirement income propositions and that additional ways of supporting customers through important decisions will be required.

Gaps in the market

For example, 80% said they wanted a product which provided a guaranteed income for life – yet only a minority of customers are currently purchasing an annuity product, which offers just that. And 55% said that a predictable income was important to them for budgeting, yet the majority of people currently select a product where their income is dependent on investment returns.

In the report, Scottish Widows outlined three factors which influence people’s retirement choices, ‘control’ (income for life vs flexibility to decide what they spend and when), ‘consistency’ (consistent or variable monthly income), and ‘legacy’ (passing on the pension pot in case of death).

The report reveals that more than two in five (43%) said ‘control’ was their primary decision point. ‘Legacy’ was the second most important factor, with a third (33%) of respondents driven by this, while ‘consistency’ drove almost a quarter (24%) of respondents’ decisions.

Qualitative research to support the new Matrix indicates that those with substantial assets outside their pension were less likely to worry about the ‘legacy’ aspect of their pension pot, while focus increased for those whose pension pot was the only potential source of wealth transfer to the next generation.

Pete Glancy, Head of Policy, Scottish Widows said:

“Auto Enrolment has been a game changer in helping more people boost their pension savings, but the model determining how retirees will access their funds in retirement could use a similar shot in the arm. The options at retirement can be daunting and complex, and people who can’t afford the services of an Independent Financial Adviser may inadvertently make choices which do not meet their needs, and those of their family. At the same time, policymakers are still working through regulatory and legislative changes which will determine what is and isn’t possible in the future.

“People are telling us loud and clear what they want, but not everything they want is currently available, or indeed permitted. Continued collaboration between the pensions industry and policymakers is required to determine what is needed and then deliver it.

“This research is another illustration of why an independent Long-Term Savings Commission, that considers UK financial resilience in the round, is necessary to deliver the future we want for Britain in retirement.”

Guidance and support

The new report also explores how people would like to receive financial support*. The FCA has recently floated the idea of using ‘choice architecture’ more widely in customer conversations. This looks to be a popular proposal with 38% of respondents expressing a preference for a service where the pension provider offers them a specific outcome, after taking them through a series of questions.

Less popular options included full advice, (14%), simplified advice (14%), guidance (17%), and ‘none of these’ (18%). Attitudes towards the five proposals largely remained consistent across pot sizes, albeit with a preference for full advice from respondents with the largest pots over £300k.

People with more than one pension pot tended to want support which related to all of their pots collectively. 81% of people with three or more pots wanted support which considered all of their pots. These results suggest that Pensions Dashboards will have an important role to play.

Emma Watkins, Managing Director for Retirement, Scottish Widows said:

“Helping people make the most of hard-saved pension pots is not only a priority for Scottish Widows but a national priority. Our research has placed the customer and their needs front and centre of this debate, and it clearly shows that customers need better support when it comes to making these important retirement decisions.

“This research and the Retirement Matrix model can help pension schemes and providers to design products that meet customer needs, within the bounds of what is permissible today, and help inform the policy debate on what could be permissible tomorrow.”

The report concludes with a list of recommendations to address the ‘decumulation dilemma’:

Products can be used in tandem to better meet the needs of more people. But we need to ensure that those who can’t afford the services of a financial adviser can get the support they need to make decisions on how to blend existing products to meet their personal requirements.

Download full press release (PDF, 274KB)

Notes to Editor

Research was conducted by Quadrangle in December 2023 and January 2024 amongst 1500 respondents.

*Support options included in research:

About Scottish Widows

Founded in 1815, Scottish Widows is part of Lloyds Banking Group, the UK’s largest digital bank and financial services group. With more than £210bn assets under administration and 6 million customers, Scottish Widows’ award‐winning product range includes workplace and individual pensions, annuities, life cover, critical illness, income protection as well as savings and investment products. Customers can access our products and services through independent financial advisers, directly, and through all Lloyds Bank, Bank of Scotland and Halifax branches.