Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Our role is to deliver good investment outcomes to help our customer build their future financial security.

Global challenges facing society today, like climate change, make our role even more important. So we’re fully embracing responsible investment practices to allow us to manage risks and returns in a more effective way, in the funds we offer to safeguard our customers’ long-term savings.

This means we aim to invest, where we can, in companies that are working hard on things like reducing their impact on the environment and people. And excluding those that are causing severe harm to the planet or society.

By investing in this way, it doesn’t have to mean you’re sacrificing investment growth. Research* shows that companies that are run in a sustainable way also tend to do well in the longer run. They’re typically better positioned to adapt to long-term challenges, such as climate change. And they’re less likely to suffer falls in their value from scandals or fines, or because they have fallen out of favour with their customers or investors.

* ESG and Financial Performance, by NYU Stern Center for Sustainable Business and Rockefeller Asset Management.

We’ve set out our Responsible Investment Framework, supported by Stewardship and Exclusions polices. They guide our decisions on how we invest, how we select fund managers, and how we challenge the managers of companies we invest in on behalf of our customers, to improve the way they operate.

Responsible Investment Framework (PDF, 3MB)

It’s important to understand how companies behave in relation to the planet and people, and the way they’re managed. These are known as environmental, social and governance factors – or ESG for short. They are used to inform decisions about the companies we invest in.

We’ve carried out research to better understand our customers’ views on responsible investment and their priorities and needs so we’re best able to support them.

ESG - what resonates with pension investors (PDF, 1MB)

Investing responsibly for the future (PDF, 2MB)

Our pilot polls on the Scottish Widows App offer a glimpse into workplace pension savers’ views on ESG issues.

Read our report (PDF, 4MB)

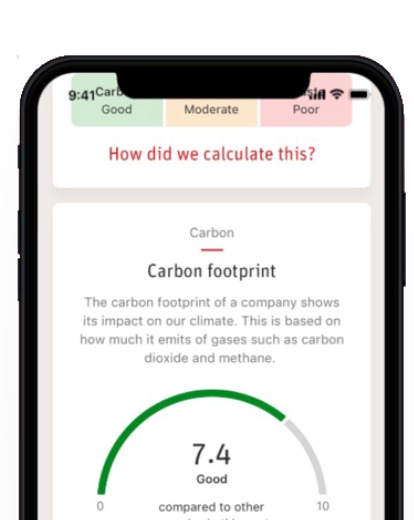

Our Find Your Impact tool is available to people whose workplace pension is with Scottish Widows and who have access to the Scottish Widows App. It aims to help people understand how their pension savings impact the world around them.