Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

A workplace pension is provided by your employer when you join the company. A percentage of your pay is paid into your workplace pension automatically every payday. You can choose how much you pay in, but there is usually a minimum amount.

Did you know:

| Here’s an example: | ||

|---|---|---|

John pays £80 into his pension scheme each month |

+ | £80.00 |

| His employer puts in £60 | + | £60.00 |

| And he gets tax relief of £20* | = | £20.00 |

| That means £160.00 is going into John's pension from his £80 contribution | £160.00 | |

*If you are a Scottish or Welsh taxpayer the tax relief you will be entitled to will be at the Scottish or Welsh Rate of income tax, which may differ from the rest of the UK.

We've based this example on automatic enrolment, where the minimum contribution is 3% from the employer, 4% from the employee and 1% in tax relief. This would be the minimum automatic enrolment contribution for someone with pensionable earnings of £24,000 each year. Many workplace pension customers may get tax relief in a different way. Tax rules can change.

There are two main types of workplace pension:

Defined contribution

This is the most common type of workplace pension.

Money paid in by you and your employer is invested by a pension company like us. How much you’ll get back will depend on:

There is no guaranteed income or pension value attached to this type of pension.

Defined benefit

This type of pension, sometimes called a 'final salary' pension, is a lot less common now.

A personal pension is a defined contribution pension that you, or your financial adviser, select.. You choose the pension company and how it’s invested and pay the contributions yourself.

You normally get tax relief on your contributions. The money you’ll get from a personal pension in retirement will depend on:

Other types of personal pension:

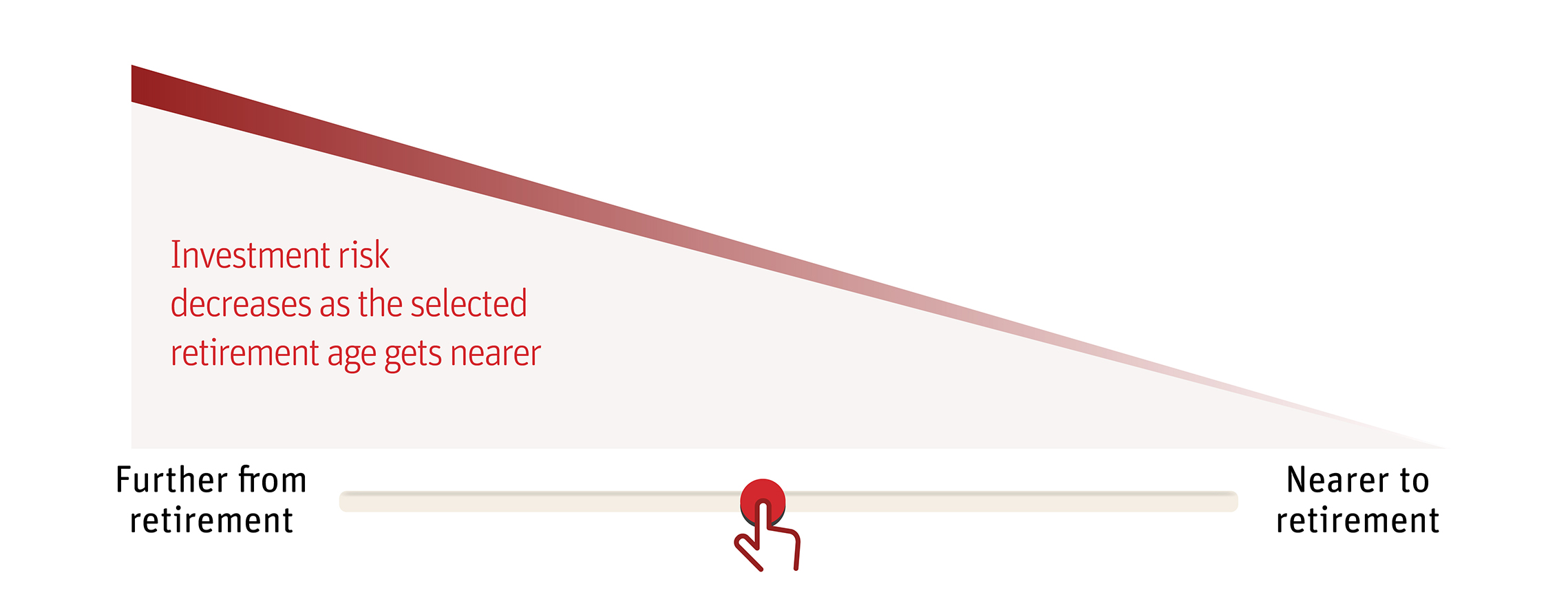

Your pension might offer what is known as a lifestyling option. This automatically moves from higher-risk investments in the early years, when you can normally afford to take more risk, to lower-risk investments, as you approach your selected retirement date.

With newer lifestyle options, as you move closer to your retirement date, the investments you’re in will depend on the retirement option you selected. This could be cashing in your pension savings, buying an annuity to provide a guaranteed income for life, or remaining invested to draw an income when you want.

The State Pension is a guaranteed regular payment for life you get from the Government once you reach the state pension age, provided you have at least ten years’ worth of qualifying national insurance contributions. Your state pension age depends on when you were born.

The amount you get will depend on the length of time you have made national insurance contributions. The government will then pay you your state pension – a guaranteed income – for the rest of your life.

For men born before 6 April 1951 and women born before 6 April 1953, read more about the State Pension here

For men born on or after 6 April 1951 and women born on or after 6 April 1953, read more about the new State Pension here

Check your State Pension forecast

For more information about pensions please view our helpful video:

Read more on the different types of pension on the Money Helper website.

We hope this information has helped, if you want to understand more go back to learn more about investing.