Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

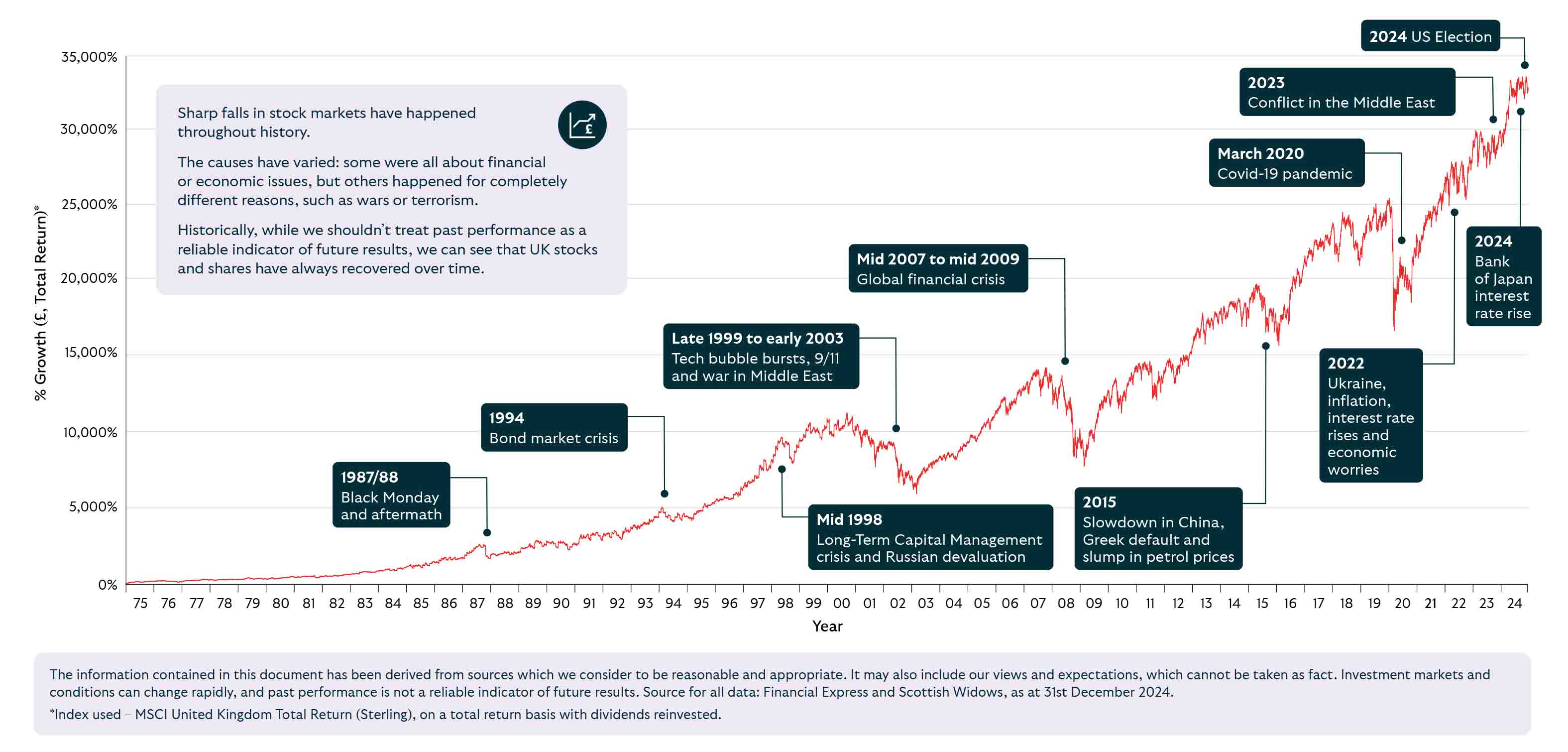

In the wake of some recent stock market volatility, it’s important to take the long view when it comes to your pension and investments.

Volatility, or sudden sharp movements, is a common aspect of share price performance.

While it can be unsettling, it's important to remember that it's typically short lived. And, because your pension is invested for the long term, it's designed to ride out these short-term shifts.

Stock markets have been experiencing some volatility - sudden sharp movements - in recent weeks. This has largely been driven by what's been going on in the US, for example, changes in government policy like tariffs or taxes on imports into the country. The effects haven't been confined to the US stock market, however, with some knock-on effect on other markets - particularly in those countries affected by these tariffs.

Market volatility can cause the value of your investments, including pensions, to go up or down quickly.

If we look at the historic performance of the UK equity market, we can see how sharp falls are often short-lived. Different markets around the world will have periods of volatility, however as a rule they tend to recover over time. Download this graph: UK equity performance over time (PDF, 233KB)

This information has been derived from sources which we consider to be reasonable and appropriate. It may also include our views and expectations, which cannot be taken as fact. Investment markets and conditions can change rapidly, and past performance is not a reliable indicator of future results. Source for all data: Financial Express and Scottish Widows, as at 31st December 2024. *Index used – MSCI United Kingdom Total Return (Sterling), on a total return basis with dividends reinvested.